You can invest with Rakuten points! Detailed explanation of benefits and how to get started

Rakuten points can be earned efficiently by shopping on Rakuten Ichiba, so there are probably many people who concentrate on collecting Rakuten points. In fact, Rakuten points can also be used for investment. In this article, we will explain in detail about Rakuten Securities' "point investment". We will also introduce point investment services of other companies, so if you want to start point investment, please refer to it.

Contents

What kind of service is Rakuten Securities point investment?

As the name suggests, Rakuten Securities' "point investment" is a service that allows you to invest using Rakuten points. Investing usually requires a certain amount of capital (cash), so many people may not be able to start even if they want to if they cannot prepare funds for investment. Rakuten Securities' "point investment" allows you to easily start investing with Rakuten points that you have accumulated on a regular basis.

You can purchase stocks and investment trusts only with Rakuten points that you have accumulated steadily instead of cash. It is also a nice point that if the result is good, you can cash it.

You can invest with Rakuten Points

Rakuten Points can be used for shopping at Rakuten Ichiba, using Rakuten Books, Rakuten Travel, making payments with Rakuten Cards, charging Rakuten Edy, etc. It collects in the whole service of. One way to use the accumulated Rakuten Points is to invest in Rakuten Securities. At Rakuten Securities, you can use Rakuten Points to invest in domestic stocks, U.S. stocks, investment trusts, binary options, etc. in units of 1 point = 1 yen. Of course, it is also possible to invest in combination with cash.

When you hear about point investment, you may feel that it is different from the usual investment method, but Rakuten Securities point investment is just using points instead of cash, so there is no difference from normal investment. If the investment results are good, you can earn profits, and of course you can receive dividends and shareholder benefits.

People who make their investment debut with point investment

Because the investment is not guaranteed, it is possible to lose money. The bigger the loss, the bigger the damage, so many people may say, "I don't want to do it if there is a possibility of losing."

However, with point investment, even if you lose, you will only lose your points and not your cash, so the risk is low. Therefore, even those who are afraid to invest cash suddenly can easily start investing, so more and more people are making their investment debut with point investment.

Rakuten point investment is recommended for beginners

For beginners who do not have knowledge or experience, I think that there are many things that they do not know, such as what stocks to buy and when to sell. increase. If you are investing for the first time, you can gain investment experience without risk if you can start by investing only in points with Rakuten Securities point investment.

You can learn a lot about investing by gaining actual trading experience, so beginners can start with point investments that can be done with a small amount to gain experience, and once they get used to it, they will try full-scale investments using cash. Let's do it.

Only regular points can be used

There are two types of Rakuten points: regular points and limited-time points. Regular points expire one year after the month in which the last point was earned. However, if points are earned even once within the deadline, the expiration date will be extended.

On the other hand, the expiration date of the limited-time points is earlier than that, and it is quite short, within 1 month at the shortest. In other words, once you've earned your limited-time Rakuten Points, you need to be a little quick to use them.

In that case, some people may want to invest in Rakuten points with limited-time points, but Rakuten point investment has a rule that only normal points can be used. Therefore, please use points other than Rakuten point investment for a limited time.

What is the difference between "point management" and "point investment"?

In addition to Rakuten Securities' "point investment," Rakuten also offers a service called "point management," which is a Rakuten PointClub service. “Investment” and “management” seem to be similar, but the content is slightly different.

The table below summarizes the differences between Rakuten Securities' "point investment" and "point management".

| For point investment | For point management | |

| Features< /td> | ・You can invest in investment trusts, domestic stocks, and U.S. stocks ・If you are an investment trust, you can choose from over 2,600 courses ・SPU target: Rakuten Ichiba points +1x ・You can invest by adding cash | ・Only 2 courses in total ・You can't choose your own products ・SPU applies Outside ・You cannot invest in cash |

| Securities company | Account opening required | No need to open an account No |

*As of February 9, 2022

*Source: Asset management with Rakuten points! Feel free to invest from 100 points without using your own money! | Rakuten Securities

As explained so far, "point investment" is a service provided by Rakuten Securities that allows you to invest in points instead of cash, so you can choose your own brand and invest. It is a service that is the same as the investment method. You can invest in various products such as domestic stocks, US stocks, and mutual funds.

On the other hand, "point management" is a service that allows you to easily experience a simulated investment. Here, points increase or decrease according to the fluctuation of the standard price of the target investment trust. However, you do not choose the product yourself, you only choose one of the two courses, the active course or the balance course, and you cannot specifically choose the investment destination yourself. There is no profit or loss in cash, so it is different from the investment itself, but it can be said that it is a trial experience of investing using points.

In addition, although it is necessary to open an account with Rakuten Securities for "point investment", it is not necessary for "point management" and it is easy to start.

Explanation about the features of Rakuten Securities' point investment service

Rakuten Securities' point investment can be used from the moment you create a Rakuten Securities securities account and choose the Rakuten Point Course. . Investment targets are investment trusts, domestic stocks (spot), US stocks (yen settlement), and binary options. You can choose the investment method that suits you.

Rakuten Point Investment is attractive because you can invest in points, but you can also invest in cash. You can invest the full amount with points, or you can invest part of it with points.

One of the attractions of Rakuten point investment is that you can start with a small amount. Investing may require a large amount of capital, but Rakuten Securities allows you to invest from 100 yen if you are an investment trust, so you can start with less risk.

Click here to open a Rakuten Securities accountCharacteristics of people who want to recommend Rakuten Securities point investment

I'm going to introduce you to who I can recommend to such people. Please check if any of them apply to you.Rakuten points are accumulated

Rakuten points are relatively easy to accumulate, so you can accumulate them efficiently by using Rakuten services. Many people say that they have accumulated a lot of points. Of course, Rakuten Points can be used for shopping, but for those who want to make effective use of them instead of just shopping, we recommend investing in Rakuten Points, which has the potential to increase your accumulated Rakuten Points.

I want to start investing without using cash

Usually speaking, you need a capital (cash), but there are times when you don't want to use cash. On the other hand, with Rakuten Securities point investment, you can invest using points, so you can invest without using cash. The appeal of Rakuten Point Investment is that even those who want to learn about investing but do not have cash can easily invest with points.

Interested in investing but afraid of risk

There are many people who are interested in investing but are afraid of the risks and can't afford it. Investing can lead to big profits, but it can also lead to big losses. Rakuten point investment is recommended for those who want to invest but are afraid to start. Rakuten Point Investment allows you to manage assets with points, so you can prevent loss in cash. There is a risk that points will be reduced, but the damage will be less than losing cash. For that reason, Rakuten Point Investment is recommended for those who are afraid of investment risks.

Click here to open a Rakuten Securities accountIntroducing 6 benefits of Rakuten Securities point investment

There are several advantages to investing in Rakuten points. Here are six benefits. Key benefits include:

Let's take a closer look at each of the six benefits of Rakuten Securities point investment.Easy asset management using Rakuten Securities account

With Rakuten Securities point investment, you can easily manage assets by creating a securities account with Rakuten Securities and setting a point course. It is now possible. No complicated procedures are required. Although there is an examination to create a Rakuten Securities account, the rest is easy once you have created it.

You can open a Rakuten Securities account from the next business day at the shortest if you use "identity verification with a smartphone". If you need to open an account, please use “identity verification with a smartphone” as much as possible.

Anyone can invest from 100 yen

When investing with Rakuten points at Rakuten Securities, you choose the product yourself, but with an investment trust, you can purchase from a minimum purchase unit of 100 yen. increase. In other words, you can invest from 100 points.

To order, set the point course to the Rakuten point course, select an investment trust, and enter the points you want to use. Even if the points are worth 100 yen.

Some people who hesitate to invest may be worried about the large initial investment amount. On the other hand, if you buy an investment trust with Rakuten Securities point investment, you can start from 100 yen, so you have the advantage of minimizing your loss.

Eligible for Rakuten Point Up

Rakuten Point has a program called SPU (Super Point Up). This is a program that rewards you with points when you shop at Rakuten Ichiba by using services eligible for Rakuten Points and meeting certain conditions.

Rakuten point investment is also eligible for SPU, and depending on the conditions, you can get +1 point for shopping at Rakuten Ichiba. Below are the conditions.

Conditions for +1 point for shopping at Rakuten IchibaPlease note that if you purchase investment trusts worth 500 yen or more in multiple installments, you will not be eligible.

There are many services that allow you to accumulate Rakuten points

Rakuten Securities' point investment is a service that allows you to invest with your accumulated Rakuten points, but there are many services that allow you to accumulate Rakuten points. In addition to shopping at Rakuten Ichiba, you can also use various services such as Rakuten Card, Rakuten Bank, Rakuten Travel, and Rakuten Kobo. There is also a way to steadily accumulate Rakuten points through survey monitors and web searches.

Points accumulate quickly, and you may find yourself with a lot of points before you know it. It is also possible to use the points for Rakuten point investment to further increase profits.

NISA/Tsumitate NISA can be used

NISA is a system that does not impose tax on profits earned from investments. First of all, in the case of regular NISA, if you purchase investment products up to 1.2 million yen every year, the profits are tax-free for 5 years. Tsumitate NISA is tax-free for up to 20 years up to 400,000 yen per year.

In fact, when purchasing investment products with Rakuten Point Investment, you can trade with NISA or Tsumitate NISA. In the case of NISA, you can trade in investment trusts and stocks, and in the case of Tsumitate NISA, you can trade in investment trusts that meet the standards set by the government, so please consider using NISA.

Increase your investment knowledge

Many people have heard of stocks and investment trusts, but do not know much about them. If you learn while actually investing, there is a risk of loss, so the hurdles are high.

On that point, Rakuten Point Investment makes it easy to get started and deepen your knowledge of the basics of investment. If you actually invest in points and generate profits or losses, you should be able to gain experience from there.

Then, Rakuten Point Investment has another way to learn about investment. That is Rakuten Securities' "Nikkei Telecom" service, which allows you to view business data provided by Nihon Keizai Shimbun for free, so you will have more opportunities to learn about investment.

Click here to open a Rakuten Securities accountIntroduction of 4 disadvantages of Rakuten Securities point investment

There are also disadvantages. Here, we will take up four disadvantages of Rakuten point investment, so please compare the advantages and disadvantages carefully.

There is also the risk of losing points

Investments can be profitable or lossy. This does not change even with point investment, and it is not always decided that profits will come out. Therefore, there is a risk that the points will be lost if there is a loss even with Rakuten point investment.

Of course, it's not guaranteed that you'll lose money, but you have to keep in mind that there is a risk of that happening. However, losing points is much less damaging than losing cash, so failure in point investments will be less of a shock than cash.

There is an upper limit to the number of points that can be invested

With Rakuten Securities point investment, there is an upper limit to the number of points that can be invested. is not. The maximum number of points that can be invested varies depending on the Rakuten membership rank and the product invested in. Here, let's show the upper limit of domestic stocks and investment trusts, which are representative products of Rakuten Point Investment.

| Diamond Members | Non-Diamond Members | ||

| Domestic Stocks | per day | 500,000 points | 30,000 points |

| per month | 500,000 points | 100,000 points | |

| Mutual fund (spot purchase) | per order | 500,000 points | 30,000 points |

| Investment trusts (funding orders) | Per day | 500,000 points | 30,000 points |

| per month | 500,000 points | 100,000 Points |

*As of February 9, 2022

*Source: Point Investment | Rakuten Securities | Rakuten Bank

In some cases, the upper limit is 100,000 points or more, but it is thought that there are few people who accumulate points so far, so you don't have to worry about it.

Account opening procedure required

In order to start investing in Rakuten points, you must first open an account with Rakuten Securities. Point investment is not recommended for those who say, "It's troublesome to open a securities account," but Rakuten Securities makes it easy to do the procedure on your smartphone, so it doesn't take much effort.

There is a risk of loss of principal

Loss of principal refers to a situation in which the price of a financial product falls below the original purchase price, and the value of a financial product falls below its principal. . Since investments are not principal guaranteed, it is necessary to be aware that there is always a risk of loss of principal. . Prices fluctuate greatly due to various factors such as social conditions, economic fluctuations, and natural disasters, so it is not uncommon for the value to suddenly drop significantly from the time of purchase. If you invest a lot of points and lose the principal, the damage will be great. Even though it's not cash, it's points, but it's going to be a little bit of a shock. Therefore, it is recommended to start with a small amount at first. In the case of Rakuten point investment, investment trusts can be purchased from 100 points, so I would like to take full advantage of this advantage.

Click here to open a Rakuten Securities accountHow to start investing in Rakuten Points in 3 easy steps

The steps to start investing in Rakuten Points are simple. There are instructions on the official website, but I will explain how to do it here as well. It only takes 3 steps, making it easy for anyone to use.

Open an account with Rakuten Securities

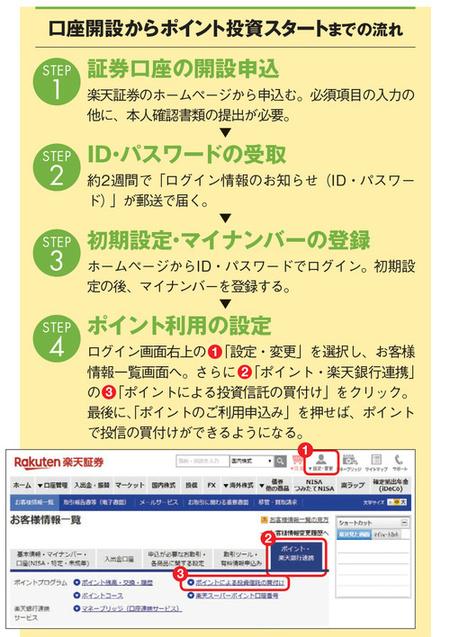

The first step to start investing in Rakuten Points is to open an account with Rakuten Securities. I'll show you how to do that step by step.

How to open an account with Rakuten SecuritiesYou will now be able to trade using your Rakuten Securities account.

Set up "Rakuten Point Course" on the official website

Once you have successfully opened a Rakuten Securities account, it's time to set up the "Rakuten Point Course". Follow the steps below.

How to set up the Rakuten Point CourseIf you have a smartphone and a driver's license or Individual Number Card, you can upload your driver's license or Individual Number Card with your smartphone to confirm your identity with your smartphone. It is recommended that the account will be opened after the business day.

Choose a financial product

The final step to start investing in Rakuten Points is to choose a financial product. Open the Rakuten Securities official website, log in, and select a financial product. You can choose from investment trusts, domestic stocks (spot), US stocks (yen settlement), and binary options.

Click here to open a Rakuten Securities account. The latest campaign information is also on the official website, but here are two campaign information for early 2022.The first is a campaign to share 2 million points by investing in US stocks or investing in points. If you enter this campaign and make a US stock reserve or point investment, 2 million points will be divided among everyone. The period is from 10:00 on January 7, 2022 to 10:00 on March 31, 2022.

*As of February 9, 2022

*Source:

There is also a campaign where you can get points for opening a Rakuten account and initial settings. If you make a purchase of 7,000 yen or more at Rakuten Ichiba within the same month and set up the "Rakuten Point Course" after opening an account, you will receive 1,000 points. This campaign is always held.

*As of February 9, 2022

*Quoted from: [Rakuten] 1,000 points for the first time using Rakuten Securities | Start 1000

Comparing Rakuten Securities and other securities companies' point investments

So far, we have confirmed Rakuten Securities' point investments, but point investments can also be made at other securities companies. It is implemented. Here, we have summarized the point investment of Rakuten Securities and other securities companies in the table below.

| Brokerage company name | Corresponding point name | Point management rule | Investment target |

| Rakuten Securities | Rakuten Points | 1 point 1 yen | Domestic Stocks, Investment Trusts, U.S. Stocks, Binaries Options |

| SBI Neomobile Securities | T points | 1 point 1 yen | Domestic stocks, FX , Neo W, etc. |

| SMBC Nikko Securities | d points | 1 point 1 yen | Stocks/ ETF/REIT |

| LINE Securities | LINE Points | 1 point 1 yen | Stocks, ETFs< /td> |

*As of February 9, 2022

*Data from official websites of Rakuten Securities, SBI Neomobile Securities, SMBC Nikko Securities, and LINE Securities Quote

Let's compare the point investment of Rakuten Securities and three other securities companies in detail.

Comparison of Rakuten Securities and SBI Neomobile Securities point investment

SBI Neomobile Securities point investment is a service that allows you to invest with T points.

The advantages of SBI Neomobile Securities' point investment are as follows.

With SBI Neomobile Securities, you can trade domestic stocks, FX, Neo W, etc. with T points. At SBI Neo Mobile Securities, you can purchase domestic stocks in units of 1 share (shares less than one unit), so there is an advantage that you can purchase stocks for 500 yen or less. Rakuten Securities does not allow the purchase of shares less than one unit, so SBI Neo Mobile Securities may be more suitable for those who want to purchase domestic stocks for a small amount.

Of course, you can buy with T points at 1 point = 1 yen, so you can start investing with less risk without using cash.

Comparison of point investments between Rakuten Securities and SMBC Nikko Securities (Nikko Froggy)

Nikko Froggy is a service operated by SMBC Nikko Securities that supports people who want to learn about investing and build assets. It is a service to

The advantages of SMBC Nikko Securities (Nikko Froggy) point investment are as follows.

Advantages of SMBC Nikko Securities (Nikko Froggy) point investment Points can be used for investment.You can invest from 100 points (100 yen for cash) using d points. Rakuten Securities cannot use limited-time points for point investment, but SMBC Nikko Securities (Nikko Froggy) can also use limited-time/purpose points. In addition, you can freely trade from about 3700 stocks, ETFs, and REITs without any fees up to 1 million yen. Of course, you can also receive dividends and preferential treatment, so it is a recommended investment method for those who accumulate d points on a daily basis.

Comparison of Rakuten Securities and LINE Securities point investments

LINE Securities also allows point investments using LINE Points. The benefits of LINE Securities point investment are as follows.

Benefits of investing in LINE Securities pointsLINE points are points that can be earned by using LINE services, completing LINE point club missions, and paying LINE Pay codes. You can use these LINE points to invest in LINE Securities. Points can be easily invested simply by entering the number of points used when depositing LINE Securities.

In addition, LINE Securities can also use “Ichikabu”, which can be purchased in units of one share (less than one unit), so you can easily start investing in points from a few hundred yen. Rakuten Securities cannot purchase fractional shares, so if you want to buy a small amount of shares, you may want to start with LINE Securities.

Since it is easy to open a LINE Securities account using LINE, it is recommended for those who regularly use LINE services.

Click here to open a Rakuten Securities accountIntroducing easy point investment and management services

Point investment can also be used in some famous point services. Since it is easy to start without opening an account, it is recommended for those who want to experience investing first. Here are some of the point investment and management services provided by each point service.

Rakuten PointClub's "Point Management"

Apart from Rakuten Securities point investment, Rakuten PointClub offers a "point management" service that allows you to easily manage your points. The features of Rakuten Point's "point management" are as follows.

Features of Rakuten Point's "point management"Rakuten Point's point management can be started immediately by selecting your favorite course from the "Active Course" or "Balance Course" and deciding the number of points to be managed. increase. Of course, there are no commissions, so it is recommended for beginners who want to manage their Rakuten points in addition to having accumulated Rakuten points.

PayPay's "Bonus Operation"

PayPay is an application that allows you to easily make payments with a single smartphone, but when you make a purchase, you will receive a PayPay bonus. We provide a service that allows you to manage this accumulated PayPay bonus. The features of the PayPay bonus operation service are as follows.

Features of the PayPay Bonus Operation ServiceNo procedures such as ID registration or account opening are required, and you can start the operation service simply by choosing from 3 types of courses. There are no fees, and you can easily experience a simulated investment.

PayPay's bonus operation can be started from 1 yen, and you can deposit and withdraw at any time. It is an investment method that anyone can easily start.

d POINT "Point Investment"

The point investment service can also be used for d POINTs. The features of d POINT point investment are as follows.

Features of d point point investmentd point point investment allows you to have an investment experience while managing d points. No account opening or fees are required. The number of points changes daily and is easy to add and withdraw. In addition, d points (limited period and use) cannot be used.

Click here to open an account with Rakuten Securities I think there are many people who don't know if they should. Here, we will introduce 5 points when choosing point investment, so please refer to it when you actually use it.1. Select a securities company based on investment targets such as stocks and investment trusts

Each company's point investment differs in what you can invest in. There are various options such as domestic stocks, US stocks, investment trusts, etc. First, you need to check what you can invest in with the point investment you are going to use.

For example, with Rakuten Securities point investment, you can choose products from domestic stocks, investment trusts, US stocks, and binary options, but with LINE Securities point investment, you can only choose stocks and ETFs, so you can only invest in stocks. If you want to buy investment trusts without buying, you can say that rakuten securities is suitable.

However, LINE Securities has a service called "Ichikabu" that allows you to trade shares in units of one share (shares less than one unit), but Rakuten Securities does not handle shares less than one unit.

In this way, the products handled by the securities company differ greatly, so be sure to check thoroughly before using.

2.Choose based on how easy it is to accumulate points

When investing in points, it is also important to check whether points can be accumulated efficiently. The faster you accumulate points, the more points you can invest. In terms of points that are easy to accumulate, for example, Rakuten points are easy to accumulate points by using Rakuten Group such as Rakuten Ichiba.

Specifically, each securities company may give points for monthly stock transaction fees and monthly average holdings of investment trusts Let's check the details of each.

If you want to buy and sell stocks, choose a service that collects points for transaction fees

If you mainly invest in stocks with point investment, choose a service that collects points for monthly transaction fees. You should choose the brokerage firm that offers it. The higher the point return rate, the more points you can receive and the more you can reinvest. Then, what is the return rate of the product? Some products have a high return rate of 1% or more, and some products have a low return rate of no return. Of course, you should choose an investment product of 1% or more.

For example, with Rakuten Securities, 1% of the transaction fee (2% for large-lot preferential treatment) will be returned as points for the super discount course. Not only domestic stock trading but also foreign stocks can be eligible for point back. The fee plan and transaction method that are subject to the return rate of the transaction fee differ depending on the point investment service, so be sure to check in advance.

For those who want to invest in investment trusts, we recommend a service that rewards points according to the average holding amount and balance

If investment trusts are the main point investment, monthly average of investment trusts Let's check the brokerage firm that has a service that gives points according to the amount held and the balance held. For example, if you register for the Rakuten Bank and Rakuten Securities account linking service "Money Bridge" and the "Rakuten Bank Happy Program" at Rakuten Securities, you will receive 3 to 10 points every month for every 100,000 yen in your investment trust balance.

Each securities company has different conditions for earning points, so be sure to check in advance.

3. Check the minimum investment amount for each service

When using point investment, how much you can invest, that is, the minimum investment amount is also an important point. If you want to invest points easily, it is recommended to choose one with a low minimum investment amount. The guideline is 100 yen (100 points if 1 point is converted to 1 yen), and at this level you can invest without thinking about risk.

However, even if it starts from 100 yen, it may apply to all investment products or only some, so please check. Also, even if the amount you can start investing is low, the fees may be high, so you need to be careful.

4. Check available trading methods such as reserve investment and NISA

Let's check what kind of trading methods can be selected for point investment. There are various types of trading methods, such as installment investment, NISA, Tsumitate NISA, special accounts, and fractional share trading, and the result will be different depending on which trading method is used.

To briefly explain the outline of each trading method, reserve investment is to invest a fixed amount of money little by little every month. NISA and Tsumitate NISA differ in the annual tax-exempt investment quota and the tax-exempt period.

There are two types of special accounts: with or without source, and if there is source, the securities company will calculate the tax and pay the tax on your behalf. In this case, no confirmation is required. If there is no source, the securities company will summarize the transaction status for one year in an "annual transaction report", and the person will file a tax return based on this.

Fractional share trading refers to shares that do not reach the number of shares of one unit.

5.Choose by low fees

When investing, you should pay attention to the amount of fees. Even if you can get a certain amount of profit, if the investment method has high fees, the profit will be reduced. Here are some of the fees involved in investing:

For stock investment, transaction fee, for investment trust, purchase fee, trust fee, etc. In addition, there are fees such as cancellation fees, trust property reserves, and monthly service fees. Naturally, if the fees are low, you can fully utilize the profits you earn from your investment, so choosing such a point investment destination is the correct answer.

Click here to open an account with Rakuten Securities . Here, I will explain how to withdraw the profits obtained from Rakuten Point Investment.An example would be mutual funds. In the case of investment trusts, cancellation procedures are required for withdrawals, but the procedure is as follows.

Cancellation procedures for purchased investment trusts

You can continue to accumulate investment trusts without canceling them, but if you want to withdraw money, you will need to proceed with cancellation procedures. Here's how.

How to cancel a purchased investment trustThis completes the procedure.

Confirming completion of cancellation

Once you have completed the procedure for canceling the investment trust, let's check whether the cancellation has actually been completed. To check the order details, click "Order status inquiry" from the investment trust top screen. The date written in "Delivery Date" is the date the money will be credited to your Rakuten Bank account.

You can cancel your order by 3:00 p.m. on the order deadline date, but if you do so, it will be marked as "Finished" and you will not be able to cancel it.

Click here to open a Rakuten Securities account. It's easier to work with. In your 30s and 40s, the burden of getting married, raising children, and buying a home increases, making it difficult to prepare the money you need to spend on building your assets.In that sense, it would be better to start building assets early in your 20s. This will make it easier to prepare for the various burdens that will increase later.

The number of people in their 20s who are interested in investing is increasing

On December 7, 2021, it was announced that the number of securities accounts at Rakuten Securities had reached 7 million. There were about 2 million accounts in January 2016 and about 3 million accounts in 2018, so it is a rapid increase. Among them, the growth in the number of new accounts opened by people in their 20s is remarkable. In 2016, 22% of the total was under the age of 20, but from January to November 2021, it has increased to 40%.

This number can be said to be proof that the number of people in their 20s who are interested in investing is increasing. I don't know what will happen to this number in the future, but it seems to be true that more and more young people want to invest early in their lives to build up their assets and prepare for the rest of their lives.

If you are in your 20s, use "time" on your side

If you invest in your 20s and later, the results will be very different. Starting in your 20s allows you to have time on your side and increase your bottom line.

Let's think about the case where you invest 10,000 yen every month. In the case of a wardrobe deposit, 10,000 yen x 12 months x 40 years equals 4.8 million yen. On the other hand, if the asset is managed at an annual interest rate of 1%, it will be 5.9 million yen over the same period of time, 9.26 million yen if the investment is 3%, and about 15.26 million yen if the investment is 5%. If you manage your assets from your 20s, 4.8 million yen can triple.

The reason for such a figure is the principle that the effect of compound interest is large, and the profit obtained from operation is invested again, further expanding the profit. Assets will snowball. If you start investing as early as your 20s, you can take full advantage of this compounding effect.

Click here to open an account with Rakuten SecuritiesEasy investment challenge with Rakuten point investment

There are many people who are interested in investing, but are unable to take the first step. Investing can lead to high profits, but it can also lead to losses. Losses are also more damaging, especially if you have invested a lot of cash.

I want to use point investment there. It is a service that allows you to invest the points you have accumulated by using various services, and it is characterized by being able to invest from a small amount. One such point investment is Rakuten Securities point investment. You can use the accumulated Rakuten points to invest in Rakuten Securities.

With Rakuten Securities' point investment, you may be able to invest as little as 100 yen, so you can easily get started. Of course, there is no principal guarantee for investments, so you may lose points, but it will be less of a shock than losing cash. Of course, there is also the possibility of getting a big profit, so please try Rakuten point investment.

Click here to open a Rakuten Securities account. There will be many people. From here on, we will show frequently asked questions and answers about Rakuten Point Investment in Q&A format, so please use them as reference information.When can Rakuten points be accumulated?

By using Rakuten Securities, you can earn Rakuten points in the following situations.

TitleIn addition to this, points can be accumulated in various campaigns.

What types of financial products do you handle?

The financial products handled by Rakuten Point Investment are investment trusts, domestic stocks (spot), US stocks (yen settlement), and binary options.

What is an investment trust?

Rakuten Point Investment includes investment trusts, but for those who do not know what investment trusts are, I will briefly explain. A mutual fund is a product in which money from multiple investors is pooled and managed by a professional. In other words, the management itself is not done by investors, but left to professionals.

Profits earned by professional management are distributed to each investor, but there is no guarantee that it will be successful even if it is managed by a professional. There is also the possibility of failure, in which case there will be a loss. The possibility of loss of principal cannot be denied.

Can I trade in the middle of the night?

Rakuten Securities trading hours vary depending on the financial product. Let's summarize the trading hours of products related to Rakuten point investment below.

Financial Products

| Financial instruments | |

| Domestic equities (spot trading) | Business days : 0:00~3:00, 6:00~7:30, 7:40~15:00 (Same day order), 17:15~23:59 (Next day order) |

| U.S. stocks | Monday to Friday: 8:00-23:30 (order acceptance), 23:30-6:00 (market trading) Time) Saturday: 8:00~2:30, 3:30~5:00, 5:15~6:00 (order acceptance time) Sunday: 6:00~2:30, 3:30~5:15, 5:15~6:00 (order acceptance hours) *Summer time is a different time |

| Investment trusts | Monday-Friday: 6:00-15:00, 15:10-3:00 (orders accepted) Saturday: 6:00-2:30, 3:30-6:00 ( Order acceptance) Sunday: All day (order acceptance) |

| Binary options | Monday to Friday: 8:20 to 4:20 the next day (trading Time) No trading on Saturdays and Sundays |

*As of February 9, 2022

*Quoted from: Trading hours and order reception hours | Rakuten Securities

How to withdraw money after investing with Rakuten Point Investment?

In addition to the website, it is possible to withdraw profits earned from Rakuten Point investment at Market Speed, Market Speed II, Customer Service Center, etc. In the case of the web, after logging in to the PC site, select "My Menu" → Deposit/withdrawal/transfer "Withdrawal" and proceed with the procedure.

| Related articles |

| ・Which account should I open, SBI Securities or Rakuten Securities? Thorough comparison of the merits and differences between the two companies ・Thorough explanation of the merits and demerits of “NISA” and “Tsumitate NISA” ・What are the merits of buying US ETFs? Introduction of recommended US ETFs for investment beginners ・Recommended selection of online securities|Introduction of recommended online securities company rankings ・What is Tsumitate NISA? Advantages/disadvantages and 10 recommended stocks |