What should I do if the address and name at the time of final tax return do not match the withholding slip due to relocation or marriage?

What should I do if the address and name at the time of final tax return do not match the withholding slip due to relocation or marriage?

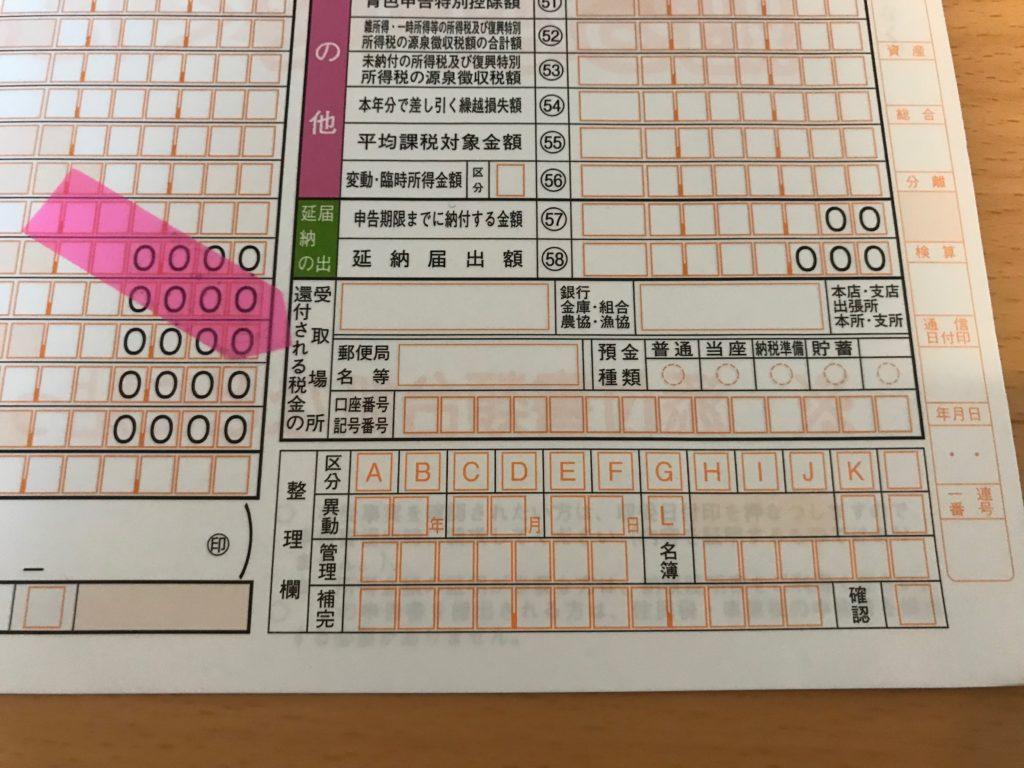

If the address and name at the time of the final tax return are different from those listed in the withholding slip due to relocation or marriage, how should we file a tax return?Also, what will the refund will be?Let's look at such cases while checking the basics of the tax return.

What is a final tax return in the first place?

Japan has a "taxpayment system" in which taxpayers declare and pay tax.The final tax return is the procedure for income tax and special income tax.Calculate the amount of all income from January 1 to December 31, the amount of income tax and the special income tax for reconstruction, and submit a tax return by the deadline for the tax return.It is a procedure to settle the taxes paid for taxes and tax payments.The filing deadline for three years is until March 15th, 4th, 4th, 4th.

Is it necessary to file a final tax return because it was adjusted at the end of the year?

We have a "tax payment system", but there are exceptions. Income tax for those who are paid by work will be deducted from monthly salaries (withholding tax), and at the end of the year, the year -end adjustment is the final adjustment of tax payments. The year -end adjustment is refunded if the tax of the year is too much, and it is a procedure to collect if it is lacking. When the tax payment procedure is completed with the year -end adjustment, there is no need to file a tax return. It may not be completed by year -end adjustment. If the income of the side job is "200,000 yen or more a year or more" or "the salary from two or more places and the salary on the side that does not make year -end adjustment is 200,000 yen or more per year," it cannot be completed by year -end adjustments, so the final tax return. Is necessary. Even if you do not need a tax return, you may be refunded extra tax return. For example, if medical expenses cost more than 100,000 yen, donations or hometown tax payments, the first year of mortgage deductions in mortgages. If you can use the hometown tax payment, you will not need to file a tax return if you can use the "hometown tax one -stop special system". You can submit the refund tax return for 5 years from January 1 of the following year. Refunds will be prescribed after 5 years, so be sure to declare them.

次ページは:確定申告書にマイナンバーの記載するようになり便利に最終更新:ファイナンシャルフィールド