E-TAX compatible without a card reader from a PC.Enhancement of minor portal

The National Tax Agency has announced a tax return for three years (early January 2022) using My Number Cards and smartphones.It will be possible to expand the automatic input target of the declaration by strengthening the minor coordination, or apply for E-TAX without an IC card reader on a personal computer.

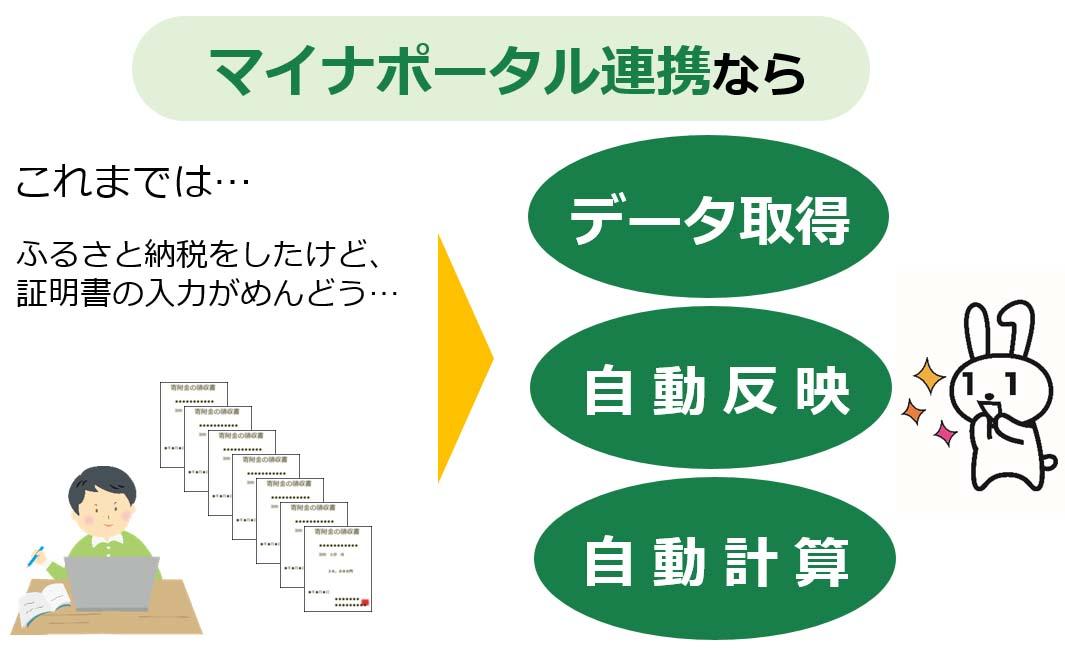

Automatic input is expanded by mini -portal collaboration

In the Minnapotal cooperation, the automatic input target of the tax return is expanded.Hometown tax payment, earthquake insurance premiums, and medical expenses are subject to mini -portal linkage, and if the corresponding certificate, the amount will be automatically obtained via a minor.

Automatic acquisition must be supported by insurance companies and other companies.The corresponding insurance companies are summarized in the NTA list.

To use the miniature collaboration, you need a My Number Card and a smartphone that supports my number card reading.In addition, medical expenses are scheduled to be obtained from Minnapotal in early February (insurance medical treatment) for September to December (2021), and will be available from Minnapotal in early February (2022 (2022) (2022).After), medical expenses notification information (insurance medical treatment) for one year can be obtained.

E-Tax from PC without IC card reader

In addition, you can apply for a My Number Card system on a personal computer without using an IC card reader.。

Even those who create a declaration on a personal computer can read the QR code displayed on the computer with the smartphone's "Minnapotal" app, so that e-Tax by the My Number Card system can be transmitted.In addition, a pre -settings on a personal computer, which had been frequently made, is no longer needed.

Automatically input "withholding slip for salary income" with a smartphone camera

In addition, a function to take a withholding slip for salary income with a smartphone camera and automatically enter the description to the corresponding item in the "Final Creation Corner" is added.You can just take a picture with a camera and check it without entering the numbers, etc., so you can save time.

Expandable range of smartphone declaration.Reduce the number of card readings

The scope of smartphone declaration is also expanded.Specified account annual transaction report (transfer income of listed shares, dividend income, etc.), Transfer loss of listed shares (for carryover last year), foreign tax deductions are displayed in a layout suitable for smartphone screens, and input.It becomes easier.

In addition, the number of readings of My Number Cards when linking minor portal is reduced.E-TAX application has been improved so that the screen display is easy to understand.