Market investment grows 80% year-on-year, "real estate tech" exceeding 500 billion yen -- the latest trends to be read from the US chaos map

Editor's note: This article was contributed by guest writer Hiroshi Ichikawa. While working for a real estate tech company in Silicon Valley, Mr. Ichikawa is disseminating the latest trends in the United States to Japan.

While the global real estate market is an astronomically huge market of approximately 24,000 trillion yen, there are still many old-fashioned business styles remaining, and it is also an industry that has been slow to evolve with technology. Numerous start-up companies and investors are finding business opportunities here, and in 2018, the total investment in real estate tech worldwide is expected to exceed approximately 500 billion yen, an increase of 80% compared to the previous year.

More than 50% of this total investment is invested in American start-ups, making American real estate tech one of the hottest industries in the world.

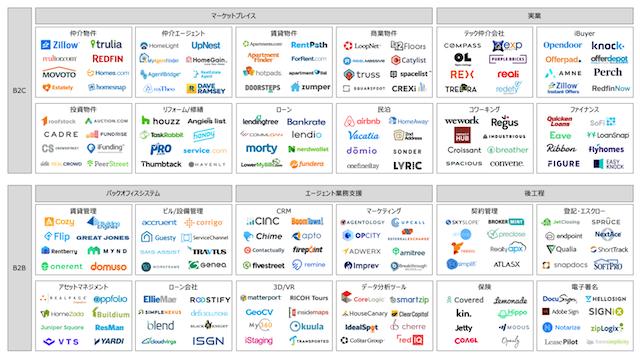

Currently, I work at a real estate tech company in Silicon Valley, and I have many opportunities to come into contact with front-line information, so I created a chaos map based on that experience. After roughly dividing it into "B2C (business for consumers)" and "B2B (business for real estate agents)", we further divided the categories into more detailed categories, and picked up 8 representative companies for each category. If you look at it, you can capture the whole picture of American real estate tech.

It would be too long to introduce individual companies, so here I would like to explain the latest trends in American real estate tech "B2C" and "B2B" respectively.

[Background]:The main battlefield for real estate tech in B2C has long been the marketplace business. Tech companies have brought information that was previously scattered offline online, allowing users to search, compare, and make decisions on their own.

From brokerage, leasing, commerce, investment, loans, and private lodging, marketplaces have been launched in all fields with a certain market size, and users' information gathering has progressed online. The opposite concept of "marketplace business" is the "business" that actually provides products and services.

In contrast to the marketplace business, which has no fixed costs and is easy to enter, business takes time and effort, and it is necessary to have fixed costs such as stores, offices, and labor costs. been shunned. However, the latest trend is that tech companies are entering this realm of business one after another.

One of the backgrounds is the red ocean of the marketplace market.

As you can see from the chaos map, many websites specializing in each field have been launched, and the white background of the market is disappearing. Another background is the magnitude of business opportunities in business. Marketplace businesses are, after all, just competing for the promotional budgets of commercial players.

If you enter the business itself, you can target the huge market that is the source of the sales promotion expenses that you have been fighting so far, and compared to the marketplace, the evolution of technology is delayed and the opportunities are great. Therefore, it is attracting attention as the next target.

[Concrete example]:There are several patterns in this when it comes to entering the business of a tech company.

①: Replacing existing business players with technology

The first is a pattern of entering the same business format as existing business players, but taking away market share by differentiating with technology. For example, in the brokerage space, tech companies such as Zillow and Realtor.com have provided marketplaces where you can compare and compare second-hand properties.

On the other hand, the huge second-hand brokerage market exceeding 130 trillion yen has been monopolized by long-established major brokerage companies, but emerging tech brokerage companies are beginning to challenge here. A representative example of a tech brokerage company is Compass, which has raised funds from Softbank with its strength in business support systems for agents. It's the exp that lowers the margin you collect.

Other discount brokerage companies (Open Listings, PurpleBricks, REX, etc.) are also increasing.

Also, with regard to finance companies, we have taken a step further from the traditional position of a marketplace where you can compare loans from multiple companies such as Lending Tree and Bankrate. Tech companies are starting to offer their own loan products. The leading ones are Quicken Loans, which offers low interest rates by specializing in online without a store, and SoFi, which has strengths in loan screening using AI.

②:Creating new markets using technology

The second pattern is to create a new market by disrupting the existing market as a business player based on the evolution of technology. A typical example is the “iBuyer” business model, which uses a price algorithm to buy and resell properties on its own rather than through an intermediary.

This business format was pioneered by startups such as Opendoor, Knock, and Offerpad, but there is a huge market in the intermediary field. Places such as Zillow and RedFin have also entered the market, demonstrating the shift from marketplaces to businesses.

In addition, even within the category of finance companies, companies that securitize properties and provide purchase funds (Figure・Easy Knock) and property purchases will be advantageous. There are players that provide unique financial solutions that are completely different from conventional loans, such as companies that provide short-term bridge loans for bulk cash purchases (Ribbon, FlyHomes). is appearing.

③: Improving the user experience with a direct management model

The strength of the marketplace is that it can present a wide range of options to users as a third party. On the other hand, since the products and services listed are those of other companies, there is the problem that user satisfaction is ultimately influenced by these companies.

In that case, companies that emphasize user experience will not take a marketplace business model, and will aim to deliver products and services directly to users themselves, even if they take the risk of having fixed costs. . In the new field of coworking space, it is easy to understand that startups are taking the approach of launching directly managed offices that reflect their own culture, rather than a marketplace where startups can search for offices.

Startups such as WeWork, Industrious, Croissant, and breather all follow their respective concepts and cultures. We have directly managed offices.

It is in a similar context that AirBnB, a marketplace for vacation rentals, started its own directly managed apartment Niido.

By designing private lodging apartments ourselves, we aim to realize the ideal private lodging as a flagship, and to improve the user experience by going one step further than the marketplace.

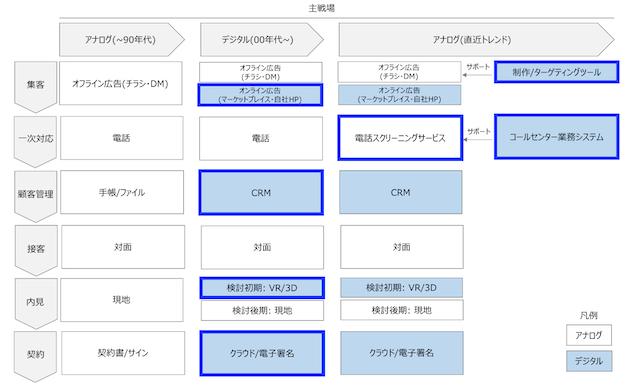

[Background]:In the past, the real estate industry was doing very analog business that relied on paper and telephones. I have grown up. Back-office systems for daily work that used to be based on documents, CRM for customer management that used to be done with notebooks and files, 3D/VR for previews at the initial stage of consideration, and data analysis tools for price assessments and marketing based on the intuition of craftsmen. , paper and signature contracts have been replaced by cloud/e-signatures.

In this way, the digitalization of business has progressed rapidly, but on the other hand, analog business that is difficult to replace with digital has been highlighted in recent years. Instead of forcibly digitizing such operations, the next trend in business is to use technology to provide back-up support while leaving analog operations as they are.

[Concrete example]:For example, with the increase in inquiries via online, agents are busy with the primary response of a large number of users with sparse seriousness, and spend time on customer service. There is a problem that it is disappearing.

On the other hand, outsource companies such as Agentology and Upcall ask, "Is the inquiry real and not a prank?" We carry out screening work over the phone to confirm items such as They have not forced to change the telephone channel itself in accordance with the reality of the industry where telephone communication is still the main communication.

Instead, we have set up a highly productive call center organization by developing our own system, and accept screening work at low cost. In addition, even though online attracting customers has progressed, analog attracting channels such as flyers still persist.

On the premise that leaflets will have a certain effect, companies such as Imprev and Breakthough Broker.com that can easily design and print orders online are gaining popularity. I'm here. In addition, Smartzip and CoreLogic are tools that propose the optimal flyer distribution area through big data analysis to acquire properties for sale, where push-type marketing such as flyers is particularly effective. offers.

In both cases, instead of forcibly changing the customer attraction channel of analog leaflets, the business is to improve the cost-effectiveness of leaflets by improving the efficiency of the production process and improving the targeting accuracy based on technology.

The B2C area of real estate originally revolved around businesses such as brokerage companies, agents, builders, and loan companies, but since the advent of the Internet, the presence of marketplaces has increased, and the recent wave of technology has increased. A new generation of business players who have ridden on are attracting attention again. The B2B field has grown by replacing inefficient analog operations with digital ones, but now that the shift has settled down, the key is how to efficiently transform the remaining analog operations.

B2C: Business→Marketplace→Business

B2B: Analog → Digital → Analog

In the form of

, although technology is the base, it is a recent feature that the evolution of the opposite vector has begun to stand out. Although omitted from the chaos map, in the B2C area, as a result of the increase in iBuyer companies and coworking space companies as business players, Sold.com for iBuyers and Marketplaces like Coworker are starting to emerge.

In the B2B area, Compass provides IoT smart billboards to support agents' work, and major brokerage firm Keller Williams provides AI assistant Kelly for real estate agents. There are also signs that digitalization will accelerate again with the latest technology, such as development and the emergence of agents who use robots to guide them remotely. These movements can be said to be rekindling the old trend of “business → marketplace” and “analog → digital”, and in this way, repeating the back and forth between business and marketplace, analog and digital, it evolves in a spiral. I think.

The blog introduces the evolution of American real estate tech while digging deeper into strategies and business models, so please read it if you are interested.

Author profile: After joining Recruit, worked at SUUMO as sales, product, corporate planning manager, and new business development manager. Currently, he is based in Silicon Valley as Vice President of US real estate portal Movoto. With more than 10 years of experience in real estate tech in Japan and the United States, he is also engaged in activities such as writing on his own Medium (blog) and real estate tech specialized media SUMAVE, consulting for Japanese companies, and deputy director of Proptech JAPAN.

BRIDGE operates a membership system "BRIDGE Members". BRIDGE Tokyo, a community for members, provides a place to connect startups and readers through tech news, trend information, Discord, and events. Registration is free.