"Furusato Tax Payment" How to use one -stop special case with the application from now on

If you pay your hometown tax, you need to file a final tax return or use the one -stop special system

Hometown tax payment is actually treated as a donation even if it is said to be tax payment.For a specific donation, there is a mechanism called "donation deduction" in which a part of it is deducted from tax by filing a final tax return, and the hometown tax payment is quite special, but one of them.It turns out that.

So, in principle, if you donate with your hometown tax payment, you need to file a final tax return (and will not be deducted).However, if there is a special case only for hometown tax payment, if you are a salary income person who does not need to file a final tax return other than the hometown tax payment, and within 5 local governments, the one -stop special system.You can do not file a final tax return (excluding those who need a tax return for inheritance or other income).

The one -stop special system is a mechanism that allows the donated municipality to be deducted without a final tax return by sending the application documents by January 10 of the following year.It can be said that it is a mechanism for salaried workers who do not require tax returns without tax payments, so that they can easily use their hometown tax payment.

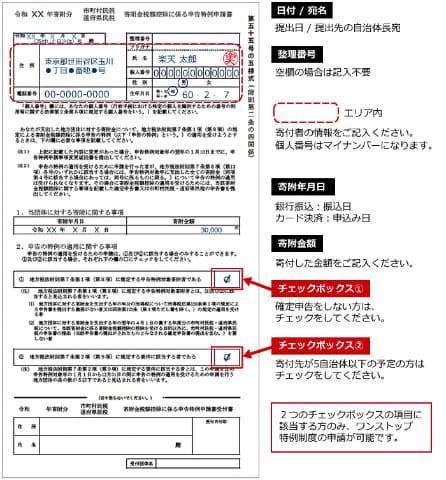

In addition, if you select the use of the one -stop special system when applying for Rakuten hometown tax payment, the application documents will be sent from the local government.After that, it is very easy because you only need to attach a copy of your My Number card and send it back.

The following is an example, but many municipalities also have a reply envelope, so there is no need to write a destination, and some local governments may not need stamps.In recent years, there are local governments that can apply online from smartphones for attached documents such as My Number Cards, and it is no longer necessary to copy them.

楽天ふるさと納税で申し込む際に「ワンストップ特例申請」の書類を送ってもらう旨を選択しておくと、自治体から申請書類が送られてくる。写真は北海道北見市の例寄付金受領証明書。確定申告する際に必要になるので、ワンストップ特例申請が受理されるまでは保管しておこう個人番号以外は記入ずみの申請書と書き方の説明。個人番号以外は記載されているマイナンバーカードの写しなどを添付するが、自治体によってはコピーを貼る代わりにオンラインで申請できる場合もある返信用封筒。自治体によっては切手が不要の場合も折り畳んでのり付けすることで封筒になる仕組みHowever, if you apply for hometown tax payment from now, if you are waiting for the local government to send a one -stop special application documents, it may not be in time for the submission deadline on January 10 (depending on the local government.You may do your best and send it right away ...).

You don't have to give up.In fact, this application documents are not so many, and anyone can easily fill in.