Column: Price transfer power of weakened Japanese companies, if it is resurrected, the stock price and price rise = Eio Kumano

Hideo Kumano Daiichi Life Economic Research Institute Economist

Read in 3 minutes

[Tokyo 19th] -The stock price is significantly different when you look at the market indicators of Japan and the United States.The contrast has expanded since the beginning of 2021.I believe that the difference in the situation of the new colon virus vaccine is reflected in it.But other structural problems are lying.

That is the difference in corporate price transfer power.In terms of textbooks, stock prices rise when prices rise.The US consumer prices were 5.4 % in June and July, compared to the previous year.In Japan, the year -on -year year in June is a slight plus, 0.2 %.Now, I feel that Japan is a country where prices are hard to rise.I feel that stock prices reflect that.

In 2021, the rise in international product market conditions accelerated.At the same time, crude oil, iron ore, iron, scrap, copper, wood, etc. were raised everywhere.In Japan, import prices have risen, and domestic corporate prices have risen in conjunction with them.In June, domestic corporate prices rise to 5.6 % from the previous year.The change is very similar to US consumer prices.

On the other hand, corporate service prices are 1.4 % year -on -year, which is a small plus.It seems that the price transfer in the manufacturing industry is relatively advanced, but it is difficult to proceed in the field of service and consumers.

In other words, even if the price of a price occurs in the river's manufacturing industry, the pace will slow down to the river and down the river, even if the price of the market has increased.And the most difficult to spread is for consumers in the final stage.

In the United States and Japan, the same cost -push pressure has occurred from the beginning of 2021, but in Japan it is difficult to link from the river to the downhill.In other words, Japanese companies are less likely to convert costs to consumers, so they will reduce floating profit (gross profit) in the middle.

If prices rise in the argument, the stock price will rise, probably when the price of this price will proceed well.If the sales volume can be increased for profit compression due to the increase in cost, the decrease in floating profit can be covered by reducing the fixed cost burden.

However, many Japanese companies are difficult to proceed due to the delay in vaccination due to the recovery of domestic sales.In that case, it becomes difficult to cover costs, making it difficult to increase profits.In Japan, it is considered that the stock price is difficult to increase because the price of the river from the river to the river is weak, as a whole.

This problem is an old and new task.The BOJ's Governor Higashihiko Kuroda was appointed in 2013, emphasizing the achievement of a 2 % increase in prices.I don't think it's much more meaningful to be able to achieve a 2 % number like a promise.

The more essential thing is whether a company has been able to pass on a price smoothly from the river to the downwater, and have regained a stubborn constitution as in the past.Certainly, I think the situation has improved compared to the late 1990s and early 2010s, which were called deflation economy.However, it is not enough to achieve it.

As in this case, if you are hit by an external shock where the market conditions of the international product rise rapidly, you will feel that the Japanese economy's legs are still weak.The Bank of Japan should not neglect this issue.

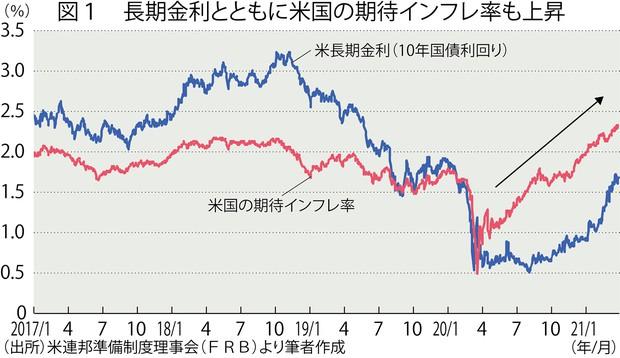

For example, the following problems are lurking.1) Will the price transfer power under the river recover if the long and short interest rates are used for a long time?2) Is it possible for people to change the expectation of the inflation of 2 % and change the expectation for prices?3) Is it easier for companies to raise their final prices due to changes in expectations?

The above -mentioned issues have been discussed among economists for 20 years, and there is a feeling that new ideas have been exhausted.The discussion has lost its freshness because he has been thinking too long, and the economist has recently left the issue of price transfer power.

Looking at US consumer prices, the rise in used car prices and air fare is noticeable.Even in the difficult industry, the price is raised to survive.This is different from the behavior of Japanese companies.

Among Japanese companies, consumers tend to be overly afraid of being shunned by consumers by raising prices.I think US companies are the focus of why they can raise prices.

In terms of macros, the fact that the Biden administration and the former Trump administration are aggressive tax cuts for households have backed up their household purchasing power.There is an impression that Japan's special fixed -rate benefits are performed without linking such prices, and the household budget simply stacks savings.

It seems that the fact that the behavior of individual companies is invisible to the behavior of individual companies is quite a factor than the macro aspect.It would be difficult to change this point, but we believe that companies that can pass on price and maintain profitability are evaluated in the stock market, and as the stock price rises, the issues will gradually improve.

After the Corona before the middle of 2010, there was such a reaction.The spread has been interrupted by the corona, but it may be resumed somewhere.

Even if you support the purchasing power of the household budget in a macro manner, such a policy will be after the behavior of individual companies has changed.Macro policy is less effective unless the microscopic behavior changes than a macro.This is one of the less than 20 years of lessons.

(This column is published in the Reuters Foreign Exchange Forum. It is written based on my personal opinion)

* Hideo Kumano is the chief economist of Dai -ichi Life Economic Research Institute.Joined the Bank of Japan in 1990.He retired in July 2000 after working for the Research Statistics Bureau and the Information Service Bureau.In August of the same year he joined Dai -ichi Life Economic Research Institute.Incumbent since April 2011.

* Contents such as news, transaction prices, data, and other information in this document are provided by columnists for only personal use of users, and are provided for commercial purposes. There is none. It is not appropriate to use this content of this document not to invite or invite investment activities, or to make a decision to make a decision when trading or buying and selling this content. This content does not provide any advice such as investment advice, taxes, laws, etc., and has no advice on individual stocks, financial investments, or financial products. The use of this document is not an alternative to the investment advice of qualified investment experts. Reuters make reasonable efforts to ensure content reliability, but their views or opinions provided by the columnist are the columnist's own views and analysis, not the Reuters' views or analysis.

Edit: Kazuhiko Tanaki

Our Code of Conduct: Thomson Reuters "Principles of Trust"